In a super-competitive talent market, employee benefits are a crucial piece of the recruitment puzzle. Even among smaller businesses, candidate expectations are high — and rising.

64% of job seekers consider whether accepting an offer will help them improve their benefits or not. Nearly everyone (96%, to be exact) thinks companies should offer health insurance as standard.

Even if your wages can’t match those of Wall Street, a comprehensive benefits package can make your small business a talent magnet. The secret is to make the benefits applicants want the heart of your recruitment strategy. Here’s how.

TL;DR — Key Takeaways

Employee benefits help attract and retain talent. Generous benefits also promote job satisfaction, giving small businesses a competitive advantage.

Healthcare is the most popular employee benefit. Small businesses can provide affordable health benefits via group plans, shared contributions, or dental and vision insurance.

Other benefits include retirement plans, injury insurance, paid time off, and flexible hours. Wellness services like gym membership may work well for smaller companies with limited resources.

When choosing benefits, balance costs and coverage. Research what employees need. Meet those needs as much as possible, but remember mandatory benefits, too.

Benefits supplement a smooth candidate experience, helping you snare the brightest recruits. Use Toggl Hire’s skills testing and ATS features to assess talent. Benefits are the icing on the cake, encouraging them to sign up.

Why are small business employee benefits so important?

No matter how big or small your business is, offering your employees perks is a smart move. Benefits can help engage existing staff, support workers in realizing their potential, and reduce employee turnover—all advantages that are hard for small businesses to ignore when they can’t offer higher salaries to compete with similar yet larger companies.

Conversely, a lack of benefits can make hiring harder, reduce employee motivation, and make it hard to keep employees when rivals offer better incentives.

In order to build a rewarding employee experience, you need to understand what matters most to your people.

Julie Bevacqua

Of course, when compared to bigger companies, small businesses are at a disadvantage. Large corporations can easily afford to offer higher wages and better overall packages.

For a small business, offering desirable employee benefits is often the best option to stand out. A well-designed benefits package levels the playing field, giving you a chance to land stellar recruits.

Types of small business employee benefits

When it comes to employee benefits, one size does not fit all. What works for a small restaurant chain might not work for a SaaS app developer. Small businesses are free to determine how they build competitive benefits packages to help attract and retain the right candidates.

Companies also tend to choose from similar benefit categories. Let’s discuss some options that might suit your situation.

Benefits should always meet employee needs as much as possible. However, as you start to look for benefits that fit within your budget, ensure the final benefits package is sustainable and scalable. It’s not just about what you can afford in the short term but also whether you can afford to offer the same benefits as your company grows.

Health

Health packages are at the top of most employee benefits wish lists. Fully paid health premiums are the number one employee benefit for US workers — a desire that even applies to workers in countries with publicly funded health systems, like the UK.

Although health benefits are almost universal among larger US businesses, the numbers for smaller businesses are unfortunately far lower.

A few healthcare options available to US-based employers include:

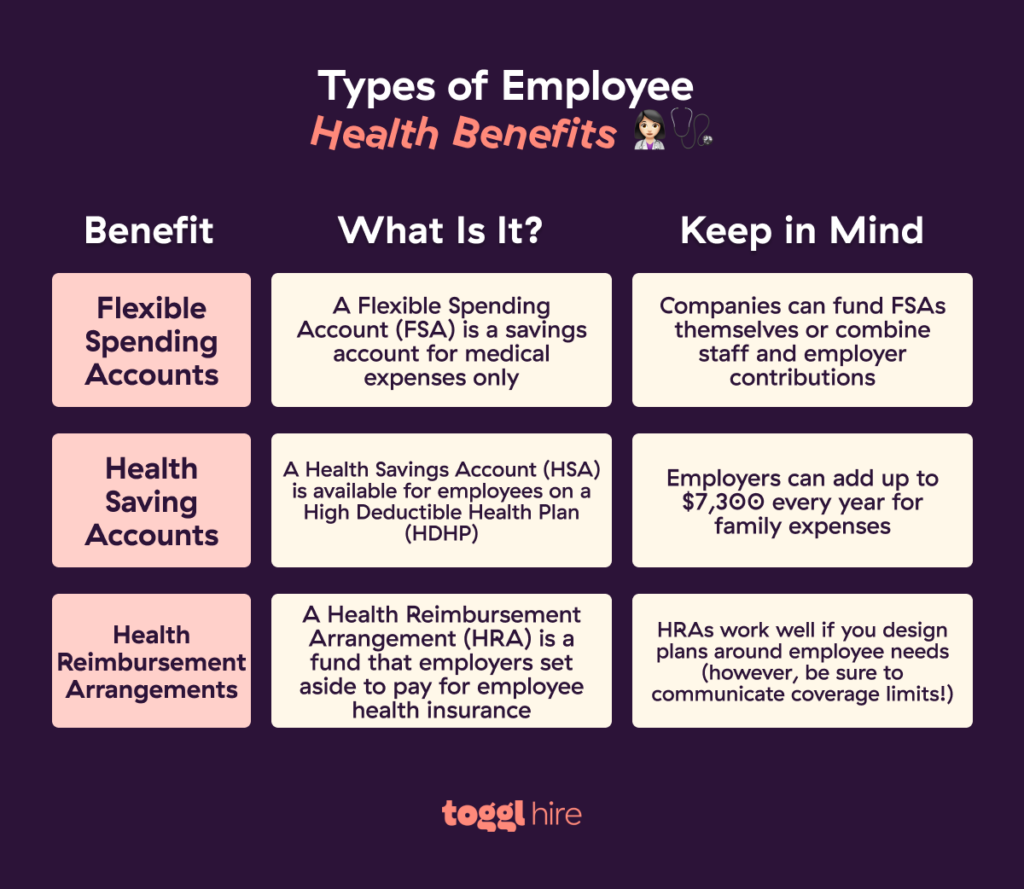

Flexible Spending Accounts

A Flexible Spending Account (FSA) is a savings account for medical expenses only.

Companies can fund FSAs themselves or combine staff and employer contributions.

Contributions are untaxed.

FSA plans tend to be flexible, covering most health conditions for employees and their families.

However, the “use it or lose it” rule means holders must spend their FSA funds during the same calendar year. A cap of $2,850 also applies to qualified medical expenses. This may lead to substantial co-pays for employees.

Health Saving Accounts

A Health Savings Account (HSA) is available for employees on a High Deductible Health Plan (HDHP).

HSAs are funded like FSAs and also help employees avoid income tax.

Unlike FSAs, funds are available at any time.

Employers can add up to $7,300 every year for family expenses.

Employees can also take HSAs with them if they change employers.

It’s worth noting that HDHPs aren’t always the best health insurance option. They often have low premiums but high deductibles when emergencies arise. If that’s not ideal for your employees (i.e., it’s not something they’ll like or get much use out of), it might be better to look into annual FSAs.

Health Reimbursement Arrangements

A Health Reimbursement Arrangement (HRA) is a fund that employers set aside to pay for employee health insurance.

Employers decide what to cover, how much to fund, and whether HRAs carry over. This gives them extra control over health insurance spending and reduces time spent on employee administration.

HRAs work well if you design plans around employee needs (however, be sure you’re communicating coverage limits to avoid misunderstandings!).

Whatever health insurance plan you choose, keep budgets in mind and always be transparent with new hires about how you support their physical health.

If you can’t offer high-end group health plans, we’ve seen some companies offer dental insurance alone as a ‘happy medium’ (although it’s not ideal). Plans with higher employee contributions can also help you reduce costs, but won’t be ideal for attracting top talent. Supplemental voluntary benefits for healthcare services, like prescription drug coverage, can help share the burden, too.

Financial

Protecting financial health is almost as important as safeguarding healthy bodies. Retirement plans, life insurance, and disability insurance are all sensible additions to an attractive employee benefits package.

The reasons are simple. Financially secure employees are usually happier and more productive. According to Morgan Stanley, 66% of employees say financial stress hampers productivity.

Moreover, 90% of Americans attribute stress to financial concerns, but 40% do nothing to solve their money worries.

Employers can win big by filling the gap with practical financial assistance. But what are your options here? Potential financial add-ons include:

Retirement benefits

401k plans are the most common retirement benefits. These plans automatically deduct a specified amount from employee wages. Employers may match the amount but don’t have to, and employee contributions are made with pre-tax dollars.

Employees can also divert their 401k funds to tracking funds or other investment options to maximize their retirement savings.

Alternatively, employees may prefer to offer Individual Retirement Accounts (IRAs). IRAs tend not to be employer-funded.

☝️ If you can’t offer the best retirement benefits, consider bolstering your small business benefits package with some access to financial education. Helping workers choose the best account for their needs is a good compromise, even if you can’t offer them more than that.

✌️ When choosing between retirement accounts, consider the fees involved in managing them as a business. SIMPLE IRAs or SEP IRAs, for example (if your business qualifies for one), don’t come with the same bureaucratic stuff other accounts do, making them often ideal for very small businesses.

Life insurance

Employee life insurance plans compensate families if workers pass away within a pre-defined period. Premiums are usually low and come with a modest employer contribution.

In really generous plans, employers pay for everything, but this isn’t that standard these days. As with health insurance, group life insurance plans offer significant savings for larger workforces, meaning this might not be the most suitable option for smaller businesses.

Disability insurance

Most employee assistance programs include financial support for long periods of illnesses or disabilities. Companies offer disability insurance in two main ways:

Short-term disability insurance allows time off for pregnancy, mental health recovery, or care duties.

Long-term disability benefits support employees injured at work or who become disabled during their time at the company.

In both cases, payments cover a percentage of an employee’s salary (generally between 50% and 70%).

Wellness

Wellness refers to employee well-being beyond healthcare and financial security. Offering wellness benefits is important, as it shows employees that you care about their happiness and well-being.

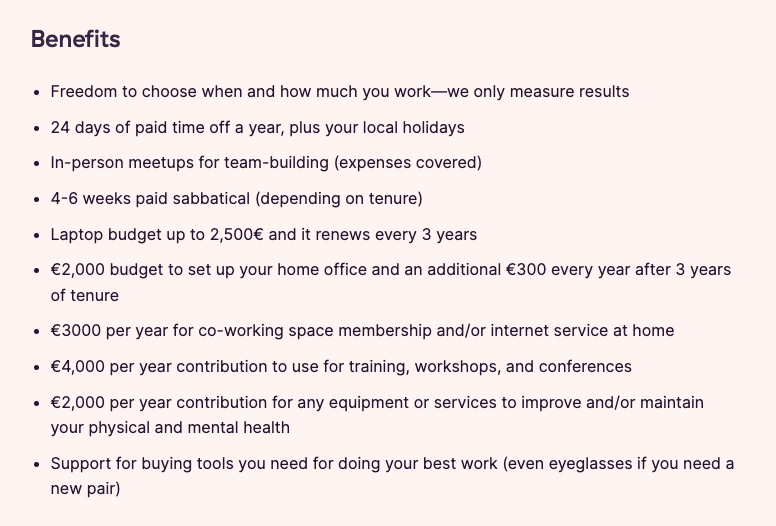

Toggl’s €2,000 per year wellness benefit is a great example. Employees can use their health budget to buy services or equipment to boost their physical and mental health. Anything that helps staff focus and enjoy their work is fine with us.

You don’t have to tailor your wellness benefits like we do, though. For example, you might consider creating employee assistance programs that link staff to counselors and mental health professionals. Some companies buy gym memberships for employees or hire yoga teachers—whatever works.

Wellness benefits can also replace more expensive health benefits. Not all small businesses can afford health insurance. Flexible and focused wellness measures are often easier to manage and support employee health.

Professional development

Other low-cost employee benefits deal with expanding professional horizons.

Small business owners might offer reimbursement for training courses or degrees. Internal training programs promise skill upgrades and advancement routes. Guaranteed conference attendance encourages networking and skill development.

Toggl Hire uses professional development to attract ambitious and positive-minded recruits. We offer up to €4,000 per year for courses or conferences. This annual budget encourages a culture of learning and motivates team members to develop their skills and abilities.

🫣 Peep our full list of benefits every employee receives (regardless of seniority).

Work-life balance

Finally, take a look at employer benefits related to work-life balance.

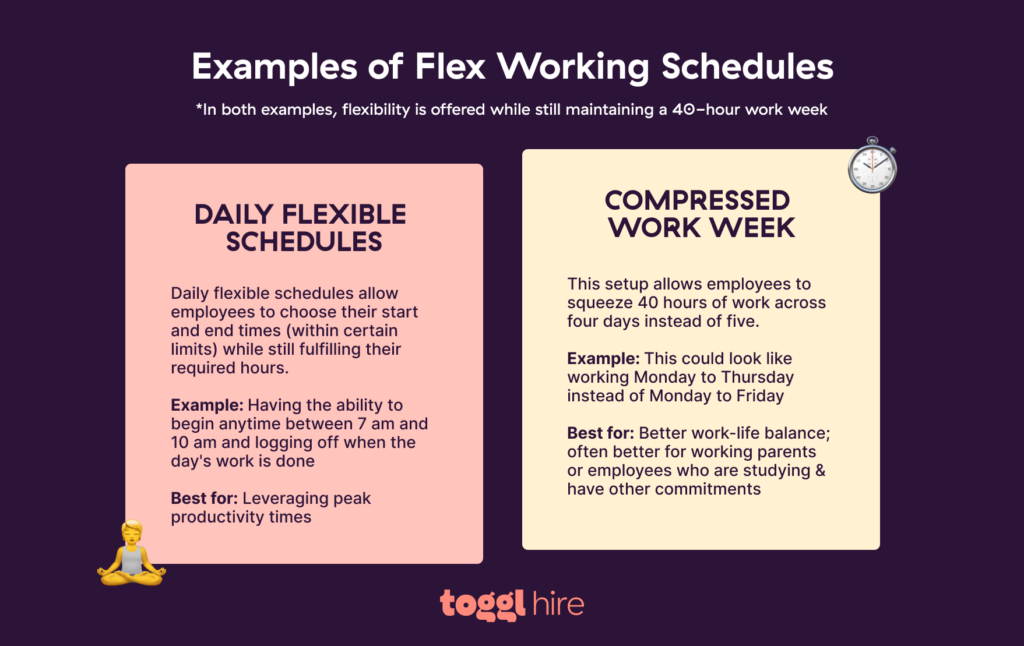

Studies show that 20% of workers would take a pay cut for lower hours and flexible work schedules. This figure increases to almost 60% of those aged up to 42. Basically, there’s no denying that work-life balance is critical to recruiting younger talent and working parents.

Employee benefits to think about that are related to work-life balance include:

- Flexible hours

- Remote working

- Extra paid time off (PTO)

- Childcare assistance

Small businesses may not be able to offer months of PTO. However, you could review each employee’s hours and discuss ways to make life easier. Simple measures like allowing shorter days for school pick-ups can make an over-sized difference.

What employee benefits are mandatory benefits?

Mandatory benefits refer to those required by law, which will vary between countries (or even states in the US). Check state and local laws in every jurisdiction where you operate, especially when expanding overseas or hiring remote workers.

⬇️ Use the checklist below to avoid costly errors.

Health insurance

Under the Affordable Care Act, businesses with over 50 employees must offer health insurance plans to employees.

Small businesses with fewer than 50 workers can also use the Small Business Health Options Program (SHOP) to find appealing, affordable employee health insurance.

SHOP puts companies in touch with registered insurers who offer discounted premiums for group health insurance.

You may also be eligible for Workplace Wellness Programs under the ACA. These incentives cover 20-30% of healthcare costs for wellness initiatives, so they are definitely worth exploring as a small business owner.

Outside the US, companies generally don’t directly provide health insurance plans. For instance, in Germany, individuals buy statutory health plans. Employers share contributions but don’t provide the benefit itself.

Unemployment insurance

Small businesses also must register for unemployment insurance. Companies pay a certain amount to the state unemployment fund per employee should the employee lose their job. The amount varies from state to state and also between sectors.

Businesses register via state portals. For instance, companies in Maine can head here to report new employees and file registrations.

Disability insurance

Five states in the USA require mandatory disability insurance: Hawaii, California, Rhode Island, New York, and New Jersey (and Puerto Rico). Elsewhere, employers can decide their own arrangements.

Workers compensation

Every US state (except Texas) mandates workers’ compensation insurance. However, wage replacement rates vary between states. Some require complete replacement, while others have minimal requirements. Additionally, some states force small business owners to fund all medical expenses, while others do not.

Check-in with state-level Workers’ Compensation Boards. WCBs administer regional programs and judge disputes between employers and workers.

FICA

All businesses must pay contributions under the Federal Insurance Contributions Act (FICA). FICA funds social security benefits and Medicare.

The total is 15.3% of employee earnings. Employers and employees each pay half (7.65%).

COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA), passed in 1985, is a federal law that ensures employees have a minimal healthcare safety net if they lose their jobs.

COBRA enables workers to stay with their current health insurers after leaving employment (as in, premiums and health coverage should stay the same).

Businesses with more than 20 employees must allow continuing COBRA coverage. However, smaller business owners don’t need to continue their contributions.

FMLA

The Family Medical Leave Act (FMLA) allows eligible employees to take 12 weeks of unpaid leave during medical or family emergencies.

If you employ over 50 people, you must offer FMLA to every worker. Eligible workers must have been on the payroll for at least 20 weeks. This includes part-time, full-time, and seasonal employees.

There are FMLA exemptions, and reasonable notice for FMLA leave can also be required. However, a generous approach makes sense. Companies denying compassionate or medical leave quickly develop a poor reputation.

What benefits do small business employees actually want?

Now that we’ve covered all the fine print let’s examine which employee benefits your real-life workforce really wants.

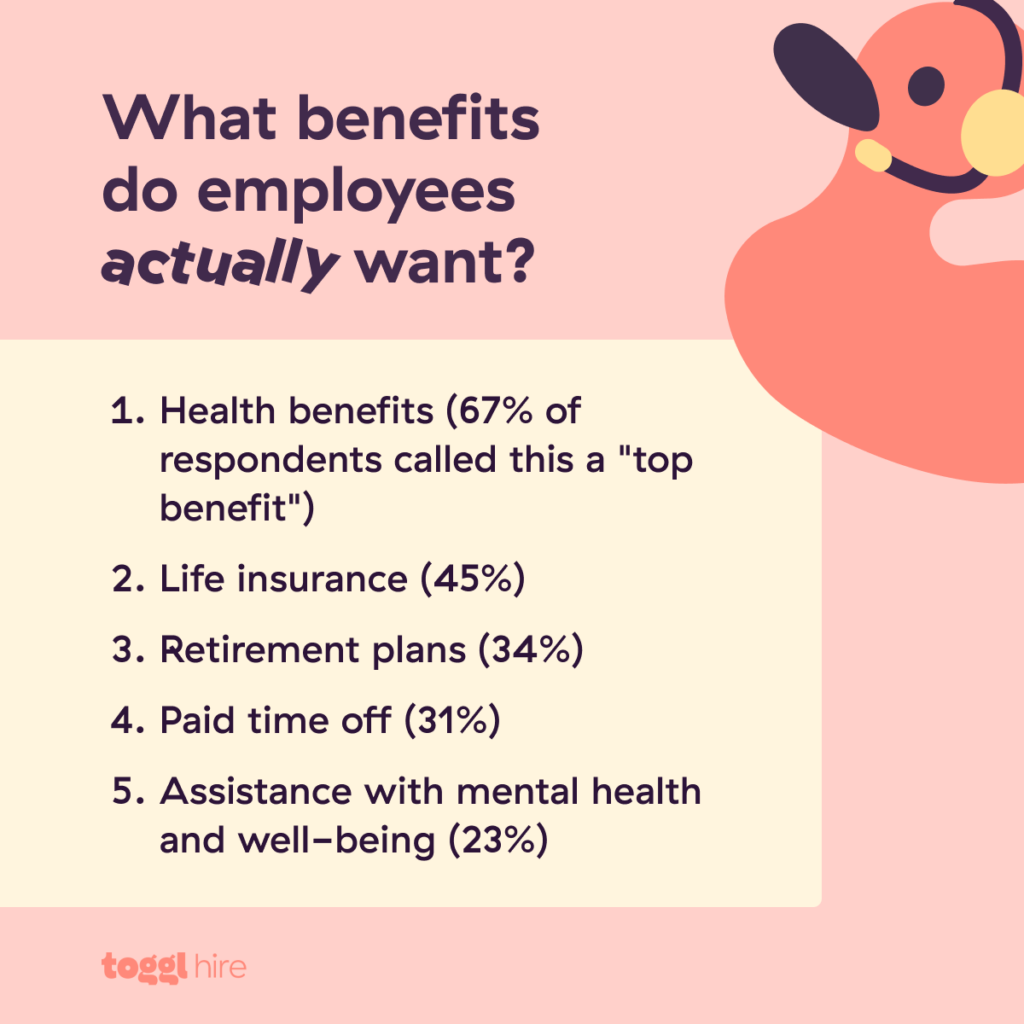

According to worker feedback from a recent Forbes Advisor survey, 51% of respondents listed work-life balance as their top priority. They ranked other benefits as follows:

Health benefits (67% of respondents called this a “top benefit”)

Life insurance (45%)

Retirement plans (34%)

Paid time off (31%)

Assistance with mental health and well-being (23%)

Note that remote employee benefits are slightly different.

Remote workers listed flexible hours as their top priority. Providing work equipment scored well. Fringe benefits like employee discounts and professional development services also figured into Forbes’ rankings for remote employees

Consider these figures in relation to your business’s unique needs. Workforces differ by location, age, family needs, gender, and a host of other factors. Choose popular benefits that match employee needs and desires. Conduct regular surveys to ensure you’ve got your finger on the pulse and know exactly which benefits your people truly value.

Non-financial benefits to keep small business employees happy

If you’re not in a position to provide generous time off or healthcare plans, think about non-financial benefits. Small gestures can make a big impact when employees understand your resource constraints. There’s scope to be creative here, too.

Flexible work schedules

Get flexible with working hours! Some surveys even rank flexible hours at the top of non-salary benefit rankings. It’s not just desirable, either; it’s beneficial. According to Deloitte, 94% of US workers would benefit from extra freedom to schedule their hours.

Mentorship and growth opportunities

58% of American workers would leave their current role if not given further development opportunities, while 61% of workers choose employers based on development prospects.

Mentorship is an affordable way to meet these aspirations. 90% of workers say mentorship benefits their careers and happiness. However, only 40% of workers have mentors.

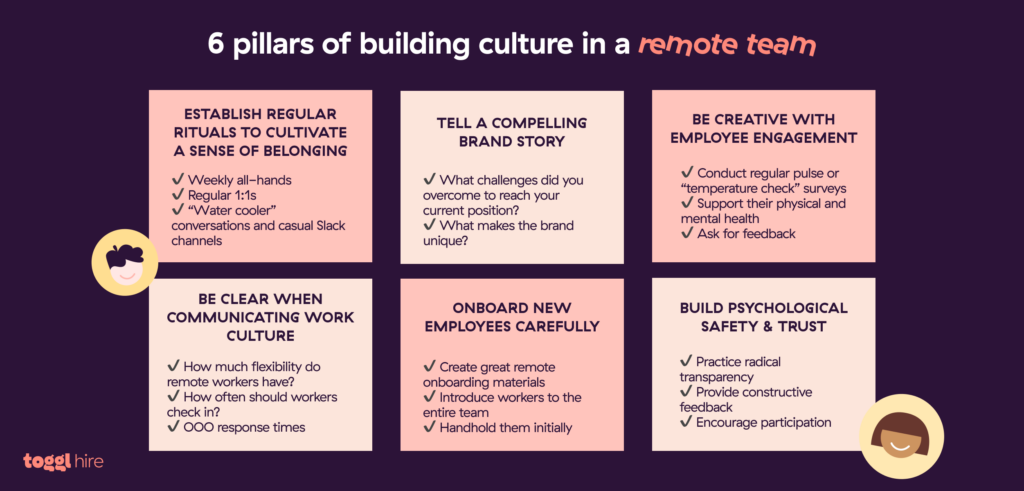

Great company culture

Promoting a healthy company culture is a powerful benefit that’s pretty much free to offer.

Strong cultures encourage employee satisfaction and career development. Almost half of Gen Z workers also say company culture is the critical factor when staying with employers.

Elements of company culture include fair pay for all, transparent promotions, and employee inclusion. Meaningful work and attentive management are also pretty important these days.

Having trouble building culture as part of a small, remote-first business? Check out our tips!

How much do small business employee benefits packages cost?

Pricing employee benefits packages varies drastically depending on the size of your business and the benefits offered.

It can cost millions for big tech giants, while a brand-new start-up will spend almost nothing. Regardless of your size, balancing cost and effectiveness is always vital. Let’s explore some price estimates to guide your planning.

Healthcare: The average cost of covering employees and immediate family members is $23,000. Individual plans cost around $8,000. By contrast, dental and vision insurance costs around $47 per month.

Retirement: In 2023, US employers matched 4-6% of salaries to fund 401k plans.

Life Insurance: Expect to pay $140-500 annually, depending on an employee’s age.

Disability Insurance: Packages take 1-3% of business employee salaries and cost employers $0.15 per hour for each covered worker.

Wellness: Wellness costs depend on what you include. Gym memberships cost about $60-70 per month. Monthly yoga packages cost around $100, but prices vary between locations.

Remember that companies often benefit from group health insurance plans. Group arrangements drive down the cost of an employee benefits package.

You can also balance employee and employer contributions to limit expenditure. Some employees prefer that added flexibility. However, ensure your focus is still on delivering benefits that make an actual difference.

How to create an attractive employee benefits program

Creating employee benefits packages is an ongoing process. As the years go by, your company will likely go through many changes, impacting the benefits you can afford to offer. Not to mention, your industry and employee expectations will also evolve over time.

To make sure your employee benefits program is attractive and relevant, repeat these steps on an annual basis.

1. Assess employee needs and preferences

Carry out workplace surveys, ask about the most popular benefits, and hold focus groups to ensure you’re listening to current employee concerns. Have an ongoing and open discussion about potential perks to bring on board.

Listen and learn. Effective benefits always meet real-world needs and improve employees’ lives. Don’t be like the 75% of businesses that fail to tailor benefits to employees.

2. Consider the budget

Financially unsustainable benefits packages won’t last long. Assess how much money you can assign to employee benefits and use this budget as the basis for future action.

Always research cost-effective health and insurance plans that deliver tax advantages for employers and employees. Then, decide whether non-financial benefits are sufficient to attract top talent.

Think about role-specific budgets as well. For instance, you can probably offer fewer benefits when hiring a freelancer. But permanent hires expect more.

3. Research and customize options

Small business employee benefits should pop out from a crowded marketplace. So, it pays to get creative when picking perks or ancillary benefits.

For example, travel assistance or staff retreats could appeal to younger groups. Pet insurance is an interesting work-life balance benefit. Dance or yoga classes blend wellness and fun. Remote work allowances also complement time off and flexible hours.

4. Clearly communicate benefits

Promote employee benefits during the hiring process and beyond. Ensure every team member knows their benefits and how to access them.

Use internal message boards, team meetings, and social media to convey the message.

Communication amplifies the value of your benefits. Employees and candidates recognize what you provide. Small businesses can boost their brand and promote a positive image by being vocal about the unique benefits talent gets when working for them.

5. Regularly review and update benefits packages

Finally, gather feedback about your benefits package. Use this information to tailor your offer.

This sounds obvious. However, many small businesses keep initially successful packages without making changes. Remember: employee demographics shift. When demographic profiles change, so should benefits.

Assess budget performance as well. Some benefits represent poor value for money, while others might be unexpectedly popular. Stay flexible and be prepared to adapt.

Other ways to attract and retain great talent

Benefits aren’t the only way to attract standout hires. Explore every option when building a small business recruitment strategy.

For instance, equity stakes help startups hire new recruits. Employee ownership promotes staff retention and motivates hires to perform. However, handing shares to employees is risky and can dilute owner control.

We discussed company culture earlier. However, cultural strategies extend beyond the workplace.

Charitable giving is a great example. 42% of employees want employers to run workplace giving programs, 66% feel companies should contribute to charity, and over 60% of workers also want employers to support community volunteering.

Younger demographics increasingly value social responsibility. Community engagement is somewhere a small business can make big gains (aside from being the right thing to do).

Dazzle small business employees during the hiring process

Candidates accept jobs for many reasons. Pay, career prospects, hours, and location all play a role. Employee benefits aren’t everything, but they can help persuade applicants to choose your company over another.

Benefits are even more effective when you use recruiting software like Toggl Hire to streamline the candidate experience. A smooth hiring process encourages promising candidates to feel positive about your company. Skills assessments help you discover the brightest talent. After that, your benefits package locks in recruits, making them more likely to sign up.

Learn more about integrating skills tests with employee benefits with a free Toggl Hire account. In our humble opinion, there’s no better way to find and secure game-changing small business talent.

Elizabeth is an experienced entrepreneur and content marketer. She has nine years of experience helping grow businesses and has experienced first-hand the impact of skills-based hiring in today's global, digital world.