Don’t think you need a certified public accountant for your business? Hmm, maybe. But we’d warn against going too long without proper accounting expertise.

A good accountant monitors cash flow, ensures tax compliance, prevents fraud, and offers invaluable strategic advice. Bad accountants raise financial and compliance risks. Not having any accounting expertise on your team leaves you at risk of losing control of your finances.

The last thing you want when trying to grow a business is to see that revenues and expenses aren’t matching up or, worse, that you’re at risk of a very expensive audit that can leave your business in bad standing. Given the risks, it’s not hard to see why elite business accountants are always in demand.

However, many business owners hesitate to hire an accountant because they deem them unaffordable or lack the financial knowledge to test accountancy skills. Don’t fall into that trap. Hiring a skilled business accountant who meets your needs is easier than you think.

TL;DR — Key Takeaways

Depending on the type of business accountant you hire, they’ll handle different tasks. Entry-level accountants, for example, record transactions and invoices, keeping your books in working order. Higher-level accountants audit financial systems, managing tax compliance and minimizing fraud risks.

Assess whether you need a full-time accountant or part-time expertise. Full-time employees are always available whenever a financial issue arises, and they’re able to learn the ins and outs of your company’s financials over time. Independent accountants or third-party staff are often cheaper and may bring specialist skills, but they’re not dedicated solely to your accounts.

Shortlist essential skills when hiring an accountant. Consider technical skills alongside soft skills such as communication or organizational skills. Look for candidates with attention to detail and experience in similar positions. Use these core skills to guide your search.

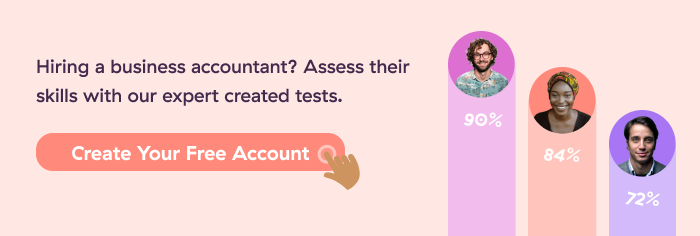

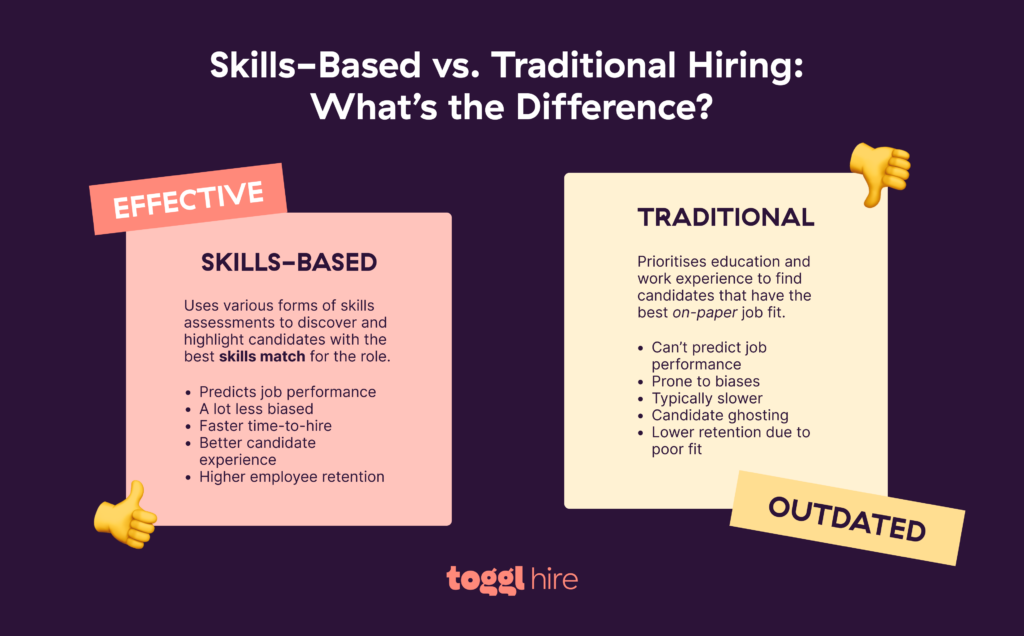

Skills testing can help you avoid bias when hiring an accountant for your business. With Toggl Hire, you can build tests for each role and compare results to shortlist the best applicants. Combine tests with strategic interviews, test days, and focused job descriptions to separate elite talent from the rest.

What does a business accountant do?

Business accountants manage corporate finances, which often includes monitoring wage payments, preparing financial reports, and meeting tax obligations.

When hiring an accountant for your business, remember there are many different types of accountants and financial professionals. Here are the main types of business accountants:

Clerks: Accounting clerks are entry-level employees. Their role generally involves data entry and bookkeeping services like processing employees’ tax codes. MS Excel skills are essential for clerks. Proficiency with advanced accounting software is rarely a dealbreaker.

Staff accountants: Staff accountants are more senior than clerks and take responsibility for managing accounting processes. They compile financial reports and support the CFO or CPAs. Staff accountants may also manage clerks or junior accountants, so the role requires a blend of management and technical skills.

Auditors: Auditors are investigative accountants. They analyze financial data to assess whether the company complies with laws and regulations. Larger companies often need internal auditors, especially when complying with the Sarbanes-Oxley Act (SOX).

Chief Financial Officer (CFO): The most senior accountant in the organization. CFOs are responsible for the company’s finances. They approve financial statements, checking their accuracy. CFOs manage organizational risks and schedule corrective actions while also carrying out strategic financial planning.

Certified Public Accountant (CPA): In the United States, CPAs must possess a certification from the American Institute of Certified Public Accountants (AICPA) and meet state requirements. They also tend to be more skilled than standard accountants. They execute SOC audits that blend cybersecurity and financial reporting processes — delivering greater assurance for business managers.

Accountants add between $30,000 and $150,000 to payroll costs, meaning you should hire with a strategic purpose in mind. Think about why you need a business accountant. Do you need more expertise to ensure compliance? Does your cash flow fluctuate uncontrollably? The use cases below will help you decide whether an accountancy hire is necessary or a “nice-to-have.”

Business advisory

All business decisions have a financial cost, but not all businesses employ experts to make financial projections and establish project costs. Accounting advice helps you plan realistic budgets and determine which course of action to take.

Accountants also take a macro perspective when analyzing financial statements. They assess enterprise-wide cash flows and expenses, highlighting ways to save money or grow revenues.

Accounting

In the post-SOX world, accurate financial reporting is critical (if you don’t want to incur severe financial and criminal penalties, which we’re guessing you absolutely don’t). Accountants maintain the integrity of financial data, including income, spending, and tax payments.

The reality is that preparing compliant annual statements is very difficult without specialist accountancy input. Internal business accountants convert raw financial information into accurate statements of the company’s finances.

Tax advice

Companies must pay taxes they owe, but they should never pay more than they need to. Accountants help by assessing tax liabilities and considering relevant exemptions or deductions.

Accountants prepare for tax time, ensuring tax returns reflect business revenues. They advise managers about how to reduce overall liabilities within the law.

Audits

In their role as auditors, accountants assess financial statements and all business financial records to ensure they comply with relevant regulations and accurately reflect business finances.

Audit functions add an extra layer of assurance for small business owners in particular. Robust auditing promotes financial security, compliance, and awareness, enabling companies to grow without hiccups.

How to hire a business accountant

Ready to hire an accountant? You’ve probably guessed by now there’s more than meets the eye when hiring a business accountant. It’s often why so many small businesses work with an accounting firm instead of bringing someone on full-time to manage their accounting system.

However, with a bit of planning, it’s not hard to find a small business accountant (or even one for a large corporation!). Before advertising the role or inviting candidates to interviews, you need to choose the correct type of accountant and whether you even need an accountant at all.

If this sounds complex, don’t worry. The steps below explain how to hire an accountant in a way that should fit into any business strategy.

1. Define your accounting needs

The first stage in hiring an accountant is understanding what accounting services you need. Do you need accountants to manage payrolls and keep daily books? Or do you need a financial advisor to provide tax advice or contribute to business planning?

Assessing your accounting situation matters as the outcome informs your recruitment parameters. For instance, if you need high-level tax advice, the job description and ideal candidate profile will include information about compliance experience with relevant tax laws.

2. Compare hiring a staff accountant vs. outsourcing

The next stage is choosing a way to meet your accounting needs. Micro-businesses may not need a specialist on staff. Third-party accounting software may do the job, and you could take a course in business accounting to learn the ropes.

However, let’s assume your accounts are a mess and compliance issues are mounting. Small business owners in this situation face a choice. They could add a permanent in-house employee or outsource accounting to a third-party firm. Both options have their pros and cons.

Hiring a permanent accountant helps you maintain control over the accountant’s focus and outputs. You can use your accountant for bookkeeping, analysis, tax advice, or internal consultancy.

Using an accounting firm or independent accountant also brings benefits. As a small business owner, you’ll have access to a wider pool of skills and expertise. Using an hourly rate to pay accounting firms or freelancers is also often cheaper compared to full-time hires.

Outsourcing is usually best if you have everyday accounting under control and need someone to handle tax returns or audits on an ad-hoc basis. Hiring permanent staff is better when long-term business stability is critical, and your financial situation allows for an extra employee.

3. Create an accountant job description and ad

If you choose a permanent hire, your next step is to start crafting an effective job description. Focus on role responsibilities and essential skills. Include required qualifications, but try not to scare off candidates with too many must-haves (they’re usually not that necessary anyway).

To attract top-tier talent, ensure you’re talking about more than just the role requirements. Include the salary! But also mention the company culture, inclusion initiatives, and employee benefits.

4. Assess the right accounting skills

Skills are everything when hiring accountants. You want to ensure you’re assessing candidates for the right skills early on in the recruitment process so you can use the later stages to assess specific knowledge and culture fit (or, as we call it these days, culture add).

Aside from the essential skills we’ve gone over above, like their familiarity with filing taxes or analyzing economic trends, think about skills that are specific to your company and industry. Ethics and integrity also matter, especially in areas regulated by SOX or GDPR.

Remember…skills tests can help you assess all of these skills or qualities. Leverage focused skills testing to find the right accountant for any position.

5. Ask the right accounting interview questions

The interview process is your chance to delve into a candidate’s personality and skills. However, time is short. So, choose strategic interview questions to assess core areas:

Technical questions assess how well candidates know accounting software and procedures.

Problem-solving questions challenge applicants to think on their feet.

Experience-based questions verify previous experience, providing a richer picture of their skills.

Scenario-based questions pose real-world situations and ask candidates to respond. They help you understand how candidates will handle workplace challenges.

Another best practice is using interview scorecards to grade candidates. Scorecards help interviewers follow a pre-defined interview structure and enable objective comparison between applicants. This means recruiters can find the best accounting professional, not the candidate who makes the best first impression.

The most important accounting skills

When you hire an accountant, skills are all-important. However, accounting is diverse and, as you can see, includes various roles and responsibilities.

If you’re hiring a CFO, they should have strong decision-making and analytical skills. Financial advisors need client-facing skills and knowledge about personal finances.

Regardless of what role you’re hiring for, let’s run through some essential skills to guide your employee selection process:

Analytical Skills: Accountants must convert balance sheets and financial data into valuable insights and financial projections. Analytical skills enable accountants (especially those working in small businesses) to influence their company’s development, improving the quality of financial decisions.

Organizational Skills: Accountants must organize financial records and storage systems, schedule audits, and meet tight reporting deadlines.

Critical Thinking: Often underrated by recruiters, critical thinking is actually crucial for a good accountant. Accountants must detect suspicious activity or balance sheet errors, identify systemic problems, and formulate solutions.

Communication Skills: Good accountants can explain complex problems in a non-technical way. In their strategic role, an accountant’s advice must be accurate and persuasive. Strong verbal and written communication is critical, especially when communicating the results of a complex financial analysis as it relates to a larger business plan.

Technical Skills: Accountants must be proficient in relevant accounting software. Auditors and senior leaders may need expertise in specific applications as well. Candidates should show a willingness to update their skills as technology evolves. Compliance knowledge is also great, including tax filing, financial reporting, and combating fraud.

Attention to Detail: Handling financial affairs demands laser-like attention to detail. A good accountant knows how to avoid errors and verifies their work.

5 tips for using skills assessments to hire an accountant

Knowing the skills you need from a business accountant is one thing. Assessing and comparing them is another. That’s why you need a standardized method to ensure you’re accurately assessing an accountant’s skills (especially if you’re not a technical, numbers-oriented person).

Skills assessments are standardized skills-focused tests that help you objectively measure someone’s proficiency in any given skill. Toggl Hire’s full test library, for example, features skill tests created by accountancy experts. Tests cover core topics like bookkeeping, financial reporting, using spreadsheets, communication, and workplace problem-solving.

When used at the right time during the recruitment process, skills tests provide high-quality, objective data. Test scores are free from interview bias and reflect concrete capabilities. Unbiased data simplifies shortlisting processes, ultimately resulting in better hires.

Identify key skills

While we (obviously) believe skills tests are a great measure of success (and there’s science to back that up, too, by the way), it’s important to be strategic about how you use them when hiring an accountant. One of the main challenges is identifying key skills and knowing what to test.

After working with various businesses over the years, our biggest tip here is to select role-specific skills to meet the needs of your own business. Your testing mix should seek hires who quickly adapt to your business context and the actual day-to-day issues they encounter.

Use expert-created accounting skills assessments

Assessment quality also matters. Accounting is highly technical and demanding, and the skills of a full-time accountant are definitely not generic. For instance, communicating financial projections or a company’s tax situation is not the same as presenting a product launch.

That’s why you should always use expert-created skills tests. You’ll find plenty of free tests online to assess accountant candidates, but they aren’t always as comprehensive or accurate as they claim to be.

That’s why financial experts with full-time accountant experience design our accountant skills tests. Test creators know how to produce statements, comply with tax laws, and handle the demands of day-to-day operations. In short, they know exactly what a great accountant should know.

Include practical scenarios

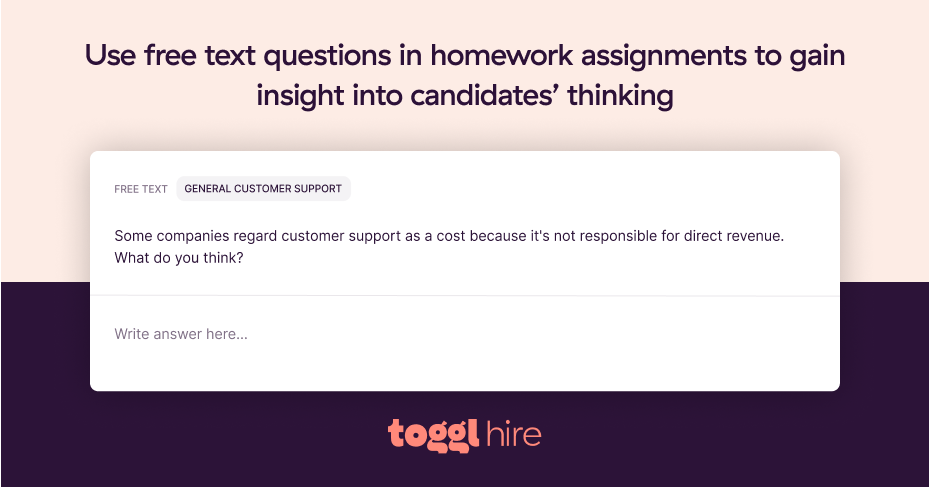

It’s not all about multiple-choice questions. Scenario-based questions challenge candidates to respond to real-life situations. These work really well as homework assignments.

Just remember: Scenarios reveal a lot about how candidates will perform in the workplace. Design assessments with everyday accounting tasks in mind. And, if you’re asking them to invest a lot of time, use this as a next-to-last step during the hiring process and pay them for their time!

Evaluate soft skills

Soft skills aren’t always associated with accountant roles. However, overlooking teamwork, communication, and problem-solving is a big mistake.

Fortunately, skills tests are able to help you assess personality traits just as well as they can help you assess someone’s ability to accurately prepare financial documents.

Problem-solving tests, for example, cast light on the ability to process debts or calculate tax liabilities. Assessing attention to detail filters out candidates who may make errors when recording transactions.

Review assessment results

Finally, don’t forget to establish ways to review and actually implement assessment results. Toggl Hire, for example, provides instant feedback when candidates complete tests. You can log these results in your candidate pipeline and quickly build skills-based shortlists.

Tip: Combine tests with interview scorecards and feedback. Build a rich profile of potential hires, considering experience, qualifications, and interview answers. Then, use objective testing to finalize your decision.

Hire the right accountant with Toggl Hire

Hiring a great accountant is a necessary part of a great business strategy, but getting it wrong can be costly in more ways than one. As we’ve seen, companies must know the skills they need and assess candidates to ensure they measure up. However, most HR teams don’t possess the knowledge of an experienced accountant, making it hard to filter candidates.

Toggl Hire’s skills tests are the ideal solution. Our accounting skills tests are designed by experienced accounting professionals and allow you to test proficiency with accounting software, tax filing, handling depreciation, managing payroll, and several other relevant accountant skills.

Pre-set tests for financial analyst and accounting clerk roles make the testing process even easier, but you can customize tests to suit role requirements. Create a free account today and make hiring an accountant more precise and efficient.

Elizabeth is an experienced entrepreneur and content marketer. She has nine years of experience helping grow businesses and has experienced first-hand the impact of skills-based hiring in today's global, digital world.